REBATE INSOLVENCY DEBT SOLUTIONS

If you are unable to pay your debts and do not see yourself being able to do so in the next few years there are now three new debt solutions which may help you.

Which option is right for you will depend on:

- How much you owe,

- The type of debt,

- Your income

- Your assets

* after Reasonable Living Expenses are deducted

** Subject to certain exemptions

*** Subject to a cap of €3 million, unless creditors consent to a higher level

****Whilst it is possible to apply for bankruptcy yourself, it is advisable to seek professional advice to assist you in the process.

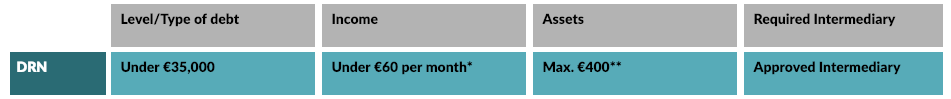

1)DRN

What is a DRN?

The Act makes provision for the issue of a Debt Relief Notice (DRN) in certain circumstances. Its purpose is to give relief from debt to people who are in debt and have little or no disposable income or assets which they could use to repay what they owe.

The qualifying debts they owe cannot exceed €20,000.

The DRN process enables eligible insolvent debtors to write off their debts where they can prove they are not in a position to repay them and it is unlikely their financial situation will improve in the next 3 years.

* after Reasonable Living Expenses are deducted

2)DSA

What is DSA?

The Act makes provision for a new insolvency procedure called a Debt Settlement Arrangement (DSA). A DSA can be entered into between a debtor and his/her unsecured creditors.

A DSA only includes unsecured debts without a limit on the amount of debt. However, certain unsecured debts cannot be included and certain other unsecured debts require the consent of the creditor prior to being included.

The DSA differs from a Personal Insolvency Arrangement (PIA) as it only includes unsecured debts. Unsecured debts are debts where the unsecured creditor would not be entitled to seize specific assets if the debtor fails to make repayments because that creditor does not hold security over those assets. Secured debts cannot be covered in a DSA. A DSA must be agreed by the debtor and approved at a creditor’s meeting by 65% of creditors (in value). In addition it must be processed by the ISI and approved by the Court.

Under a DSA, a debtor’s unsecured debts subject to the DSA, will be settled over a period of up to 5 years (extendable to 6 years in certain circumstances).

If successfully complied with, the debtor will be discharged from debts specified in the DSA at the end of the period.

3)PIA

What is PIA?

The Act makes provision for a new insolvency procedure called a Personal Insolvency Arrangement (PIA). A PIA can be entered into between a debtor and one or more of his/her creditors.

A PIA can include secured and unsecured debts, but certain debts cannot be included in a PIA and certain other debts require the consent of the creditor prior to being included.

A limit of €3m applies to the amount of secured debt that can be included in a PIA, unless all secured creditors consent to the inclusion of a higher amount.

The PIA differs from a Debt Settlement Arrangement (DSA) as it includes secured debt. Secured debt is a debt backed or secured by an asset (e.g. a housing loan where a house is mortgaged to secure the loan debt).

A PIA must be agreed by the debtor and approved at a creditors’ meeting by a qualified majority of creditors. In addition it must be processed by the ISI and approved by the Court.

Under a PIA, a debtor’s unsecured debts will be settled over a period of up to 6 years (extendable to 7 years in certain circumstances) and the debtor will be released from those unsecured debts at the end of that period.

Secured debts can be restructured under a PIA (e.g. to provide for payments for a certain period or a write-down of a portion of negative equity). Depending on the terms of the PIA, the debtor may be released from a secured debt at the end of PIA period or the secured debt can continue to be payable by the debtor (although perhaps on restructured terms).

*Subject to a cap of 3 million, unless creditors consent to a higher level.

4)Bankruptcy

What is Bankruptcy?

Bankruptcy is a process where the ownership of an insolvent person’s property transfers to the Official Assignee in Bankruptcy to be sold by him for the benefit of those to whom the individual owes debts (creditors).

Bankruptcy proceedings are brought in the High Court. The application for a Bankruptcy Order is filed in the Office of the Examiner of the High Court. When the person’s property is sold, the Official Assignee will make sure that the proceeds are shared out fairly among creditors and any outstanding debt will be written off.

Bankruptcy normally lasts for 1 year.

MAIN CONSEQUENCES OF BANKRUPTCY

- Your property transfers to the Official Assignee.

- You have a duty to contribute from surplus income (income less reasonable living expenses) towards your debts for up to 3 years.

- You are discharged from bankruptcy after 1 year.

- All your unsecured debts are written off.

*Whilst it is possible to apply for bankruptcy yourself, it is advisable to seek professional advice to assist you in the process.

Other Services we provide at Rebate Insolvency Solutions

Debt Negotiations service.

We help complete the SFS, We get your authorisation, look over your financial information, submit a proposal to your lender for forbearance Measure, get the agreement and explain the agreement. This service is carried out for you and is charged at a flat cost of €1,250.